Lifetime ISA rules explained: eligibility, contributions and penalties

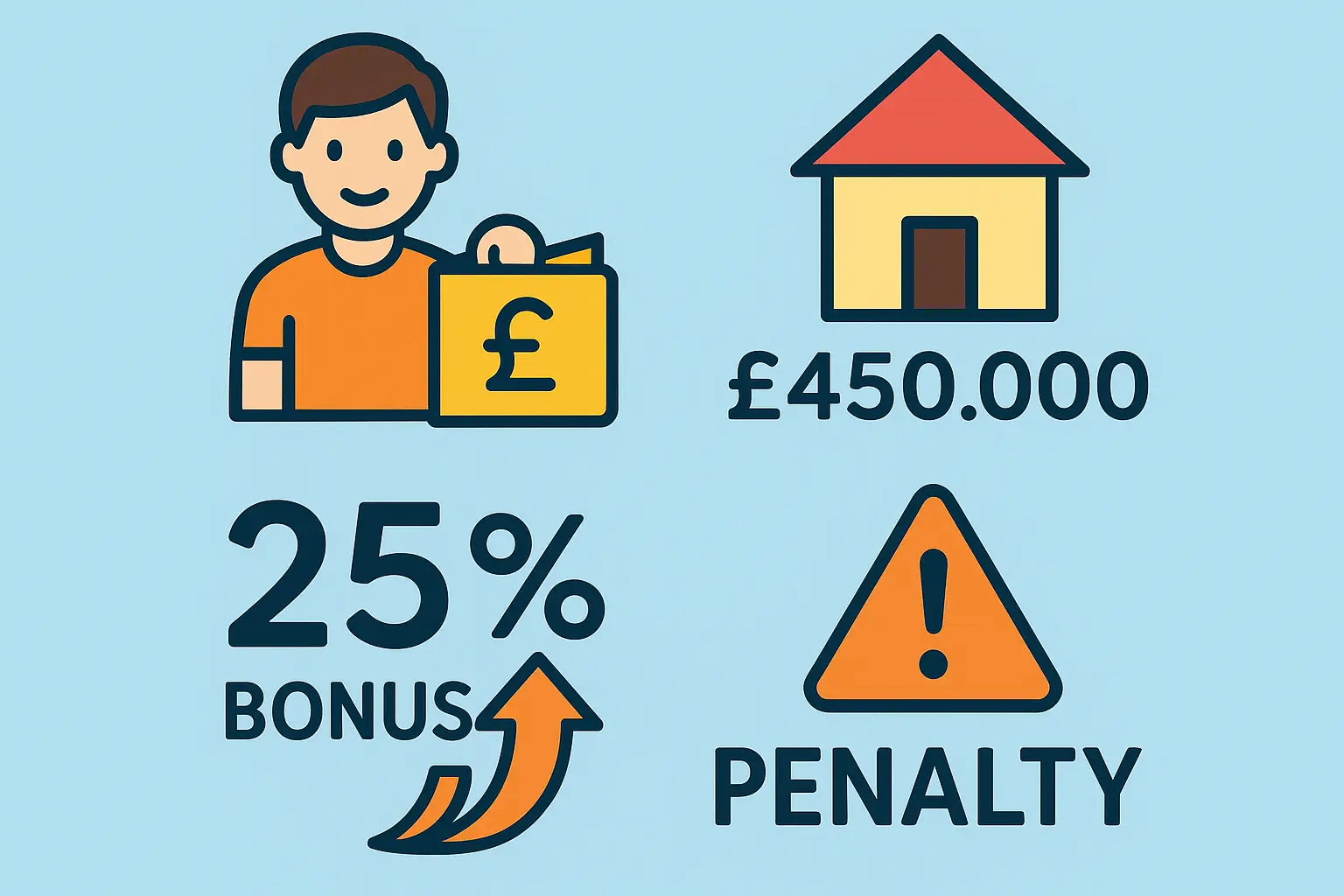

The Lifetime ISA, often called LISA, is a UK government-backed savings account designed to help young adults save for their first home or retirement. Under lifetime ISA rules, you can contribute up to £4,000 per tax year and receive a 25% government bonus, but strict conditions apply to avoid penalties. This guide breaks down the key lifetime ISA rules UK savers need to know in 2025, including eligibility, contributions, withdrawals, and recent criticisms, so you can decide if it’s right for you.

Eligibility criteria for a Lifetime ISA

To open a Lifetime ISA, you must meet specific age and residency requirements, ensuring it’s targeted at younger UK residents planning long-term goals like buying a first home.

Age and residency requirements

You can open a Lifetime ISA if you’re aged 18 to 39 and a UK resident. Contributions are allowed until you turn 50, after which the account remains invested tax-free but you can’t add more money. The lifetime ISA age rules emphasise early saving; for example, opening at 18 gives you 32 years to build funds before the contribution cutoff.

First-time buyer definition

A first-time buyer under lifetime ISA rules for first time buyers is someone who doesn’t own a property anywhere in the world or has never owned one that was their main residence. This includes those saving for a home up to £450,000; exceeding this price triggers penalties on withdrawal. The rules support affordable housing goals but have faced criticism for not adjusting to rising UK house prices.

Opening an account

Opening Lifetime ISA rules are straightforward: choose a provider like a bank or investment firm, provide ID, and confirm eligibility. You can’t have previously held a Lifetime ISA, and the process typically takes minutes online. For details, check the official GOV.UK Lifetime ISA overview.

Contribution limits and government bonus rules

The core of lifetime ISA contribution rules is an annual cap of £4,000, which forms part of your overall £20,000 ISA allowance for the tax year, plus a 25% bonus that boosts your savings instantly.

Annual allowance and deposits

You can deposit up to £4,000 each tax year (6 April to 5 April) into your Lifetime ISA, following lifetime ISA deposit rules that allow cash or stocks and shares investments. This limit is fixed for 2025/26, and unused allowance doesn’t carry over. Deposits must come from your post-tax income, ensuring the bonus applies only to new contributions.

How the 25% bonus works

The Lifetime ISA bonus rules provide a 25% top-up from the government, up to £1,000 per year, claimed automatically by most providers within 30 days of deposit. For instance, contribute £4,000 and get £1,000 free, totalling £5,000. Learn more from MoneyHelper’s guide to Lifetime ISAs.

Tax year considerations

Contributions reset each tax year, aligning with broader ISA rules. If you’re new to saving, note that the tax year runs from 6 April, so plan deposits accordingly to maximise the bonus under rules for Lifetime ISA.

| Contribution Amount | Government Bonus (25%) | Total Before Penalty | Penalty on Unauthorized Withdrawal (25% of Total) | Net After Penalty |

|---|---|---|---|---|

| £1,000 | £250 | £1,250 | £312.50 | £937.50 |

| £2,000 | £500 | £2,500 | £625 | £1,875 |

| £4,000 (Max) | £1,000 | £5,000 | £1,250 | £3,750 |

This table illustrates how lifetime ISA bonus rules work, with penalties clawing back the bonus plus an equivalent amount from your savings.

Withdrawal rules and penalties

Lifetime ISA withdrawal rules allow penalty-free access only for buying your first home or after age 60; otherwise, a 25% charge applies, which has hit nearly 100,000 savers with £75 million in fines in 2024/25.

Permitted withdrawals for home purchase or retirement

You can withdraw tax-free for a first home up to £450,000 if you’ve held the LISA for at least a year. For retirement, access starts at 60 without penalty. These lifetime ISA house buying rules require proof, like a solicitor’s letter for purchases.

Unauthorized withdrawal penalties

Under Lifetime ISA withdrawal penalty rules UK, early or non-qualifying withdrawals face a 25% charge on the entire amount withdrawn, including your contributions and bonus. In 2025, penalties have soared over £100 million as more people break the rules amid rising costs, per GB News reporting on HMRC data. What happens if you break Lifetime ISA rules? You lose the bonus and effectively 25% of your own money.

Avoiding fines: exceptions and tips

Exceptions include terminal illness or death, where no penalty applies. To avoid fines, assess your goals before opening and consider transfers instead of withdrawals.

Tip: Before withdrawing, confirm eligibility with your provider to sidestep the lifetime ISA withdrawal rules pitfalls. Compare with alternatives like Help to Buy ISAs for flexibility.

Transferring your Lifetime ISA and rule changes

Lifetime ISA transfer rules let you switch providers without penalty, but watch for fees; meanwhile, 2025 discussions highlight criticisms without confirmed changes.

Transfer process and rules

You can transfer your entire LISA or part of it to another provider, preserving the bonus and tax-free status. The process takes up to 30 days, and transfers count toward your annual allowance if over £4,000. For guidance, see MoneySavingExpert on ISA transfers.

Current criticisms and potential 2025 updates

Lifetime ISA rules criticism centres on harsh penalties and the outdated £450,000 house cap, penalising benefit claimants and young buyers in expensive areas. Are Lifetime ISA rules changing in 2025? The government hasn’t committed to reforms despite calls from experts like Martin Lewis, though record LISA usage in 2025 may prompt reviews, as noted by Hargreaves Lansdown. Will Lifetime ISA rules change? Monitor the Autumn Budget for updates.

Using LISA for joint purchases

Lifetime ISA rules buying with someone else allow joint first-home buys if both qualify as first-time buyers. Each partner’s LISA can fund up to 100% of the deposit, but the property must meet the price cap.

Frequently asked questions

What are the rules for Lifetime ISA?

The Lifetime ISA rules UK revolve around saving for a first home or retirement with tax-free growth and a 25% government bonus on contributions up to £4,000 annually. Eligibility limits opening to ages 18-39, with contributions until 50, and UK residency required. Unauthorized withdrawals incur a 25% penalty, but exceptions apply for qualifying home purchases under £450,000 or age 60 access, making it a committed long-term savings tool as per GOV.UK guidelines.

How does the Lifetime ISA bonus work?

The bonus under Lifetime ISA bonus rules adds 25% to your contributions, maxing at £1,000 per year for £4,000 deposited, claimed automatically by providers. It applies only to new money within the tax year and boosts your pot for home buying or retirement. Unlike regular ISAs, this incentive encourages early saving, though it’s clawed back on penalties, so plan contributions wisely to maximise benefits.

What happens if you withdraw from a Lifetime ISA early?

Early withdrawal from a Lifetime ISA triggers a 25% penalty on the full amount taken out, recovering the government bonus and an equal sum from your savings. For example, withdrawing £5,000 (including £1,000 bonus) nets you £3,750 after the fine. This rule deters short-term use, with 2025 seeing over £100 million in penalties; always check permitted uses first to avoid HMRC charges.

Can you transfer a Lifetime ISA?

Yes, Lifetime ISA transfer rules allow moving your account to another provider without losing the bonus or tax benefits, either fully or partially. Transfers must be done directly between providers to count as non-contributory, preserving your allowance. Fees may apply, so compare options among the lifetime isa providers before initiating, ensuring seamless continuity for your savings goals.

Are Lifetime ISA rules changing in 2025?

As of late 2025, no major Lifetime ISA rules change has been announced, despite ongoing criticisms of penalties and the house price limit. The Treasury responded to calls for reform but committed to no immediate action, per MoneySavingExpert updates. Experts speculate future tweaks to address rising fines, so stay informed via official sources; this stability allows continued planning under current lifetime ISA rules UK.

What is the age limit for opening a Lifetime ISA?

The age limit under lifetime ISA age rules is 18 to 39 for opening, targeting young adults starting their savings journey. You can then contribute until 50, giving ample time to build for retirement or a first home. This structure promotes disciplined saving from early adulthood, but if you’re over 39, consider alternatives like standard ISAs for similar tax perks without the bonus.

Can I use my Lifetime ISA for a house over £450,000?

No, Lifetime ISA first time buyer rules cap penalty-free withdrawals at homes costing £450,000 or less, a limit unchanged since 2017 that’s increasingly criticised in high-cost areas like London. Exceeding this means facing the 25% penalty on the withdrawal, potentially losing your bonus and more. For pricier properties, explore other first-time buyer schemes or consult advisors on hybrid strategies.

In summary, understanding lifetime ISA rules empowers you to save effectively. Assess your eligibility, calculate potential bonuses, and avoid penalties by aligning with home or retirement goals. For the best lifetime isa options, explore rates and providers; if unsure, seek independent advice. Next, review your best lifetime isa rates to optimise returns.