What is a stocks and shares ISA?

A stocks and shares ISA offers a tax-efficient way to invest in the stock market, allowing your money to grow without paying income tax or capital gains tax (CGT) on profits. Unlike a cash ISA, which provides steady but low interest, this type lets you buy shares, funds, bonds, and exchange-traded funds (ETFs), potentially delivering higher returns over the long term though with greater risk. For 2025, the annual ISA allowance stands at £20,000, meaning UK residents aged 18 or over can invest this amount tax-free each tax year, as confirmed by HM Revenue & Customs (HMRC) at https://www.gov.uk/individual-savings-accounts.

Eligibility requires a UK address and National Insurance number, and you can split the allowance across different ISA types. This makes it ideal for building wealth for retirement or major goals. However, remember that investments can fall as well as rise, so capital is at risk.

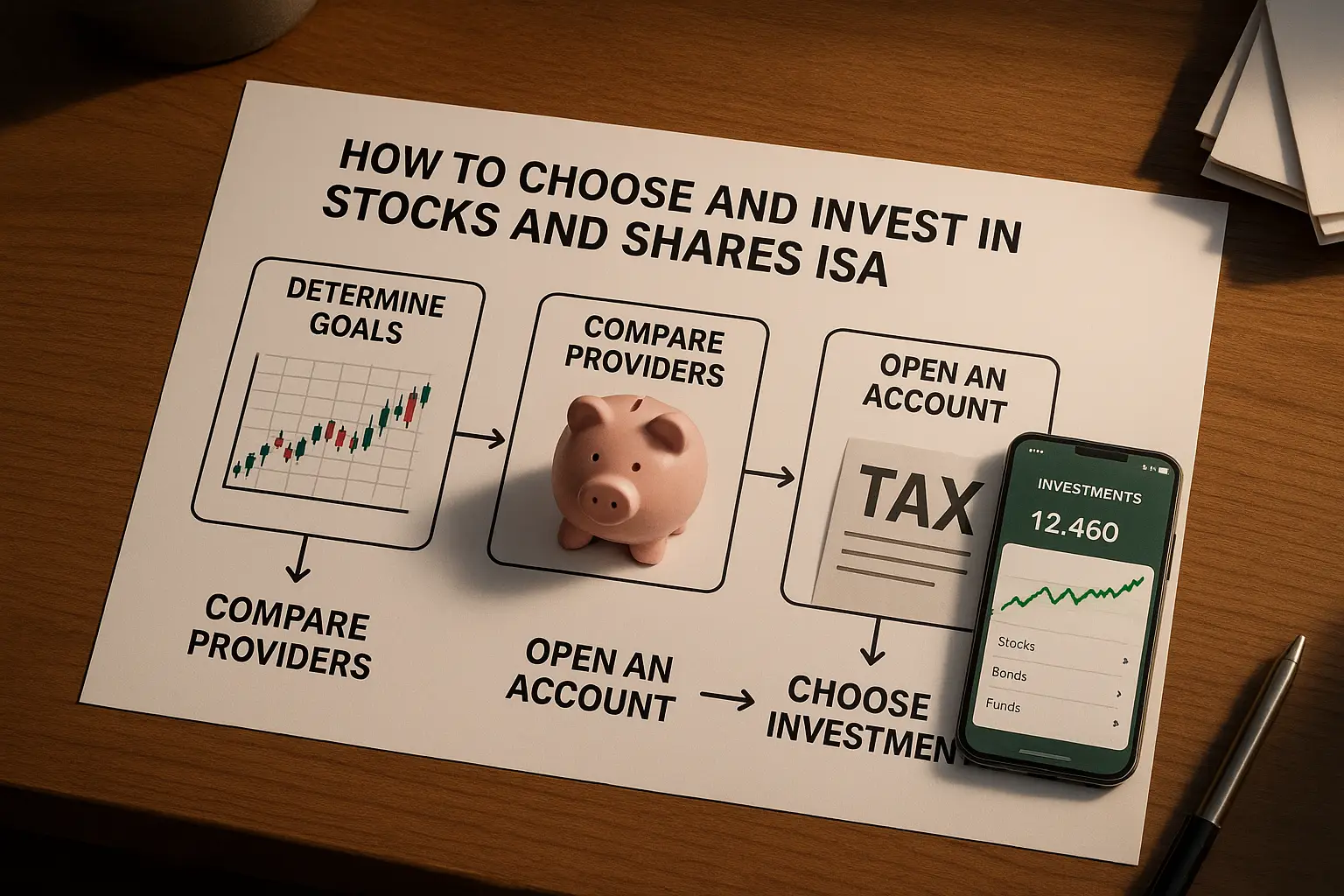

How to choose the best stocks and shares ISA provider

The best stocks and shares ISA provider for you depends on your experience level, investment goals, and tolerance for fees—prioritise platforms with low costs, wide investment choices, and user-friendly apps for 2025. Key factors include annual platform fees (averaging 0.25% to 0.45%), minimum investment requirements (often £100 or less for beginners), and customer support quality. For beginners, opt for ready-made portfolios; advanced investors may prefer extensive research tools.

In 2025, consider providers regulated by the Financial Conduct Authority (FCA) that offer ethical or flexible options amid rising interest in sustainable investing. Compare using tools on sites like MoneySavingExpert at https://www.moneysavingexpert.com/savings/stocks-shares-isas/ for cheap platforms. Always check for FSCS protection up to £85,000 per provider.

Top stocks and shares ISA providers compared

Leading providers like Hargreaves Lansdown, Vanguard, and AJ Bell stand out for 2025 due to their balance of fees, tools, and performance, making them top choices for the best stocks and shares ISA in the UK. Hargreaves Lansdown excels in research and 3,000+ funds but charges 0.45% platform fees; Vanguard offers low-cost index funds at 0.15%, ideal for passive investors. AJ Bell provides a flat-fee option (£9.95 monthly) with strong mobile trading, while Freetrade appeals to beginners with commission-free trades.

To help compare, here’s a table of key features based on 2025 data from Which? at https://www.which.co.uk/money/investing/stocks-and-shares-isas/finding-the-best-stocks-and-shares-isa-amK9w1r4F6R1:

| Provider | Annual Fee | Min Investment | Investment Options | Best For |

|---|---|---|---|---|

| Hargreaves Lansdown | 0.45% | £100 | 3,000+ funds, shares, ETFs | Research tools |

| Vanguard | 0.15% (funds) | £500 | Index funds, ETFs | Low-cost passive investing |

| AJ Bell | 0.25%, or £9.95/month | £500 | Shares, funds, bonds | Active traders |

| Freetrade | 0% trading | £1 | Shares, ETFs | Beginners |

| Interactive Investor | £4.99-£19.99/month | £25 | Wide range | Flat-fee value |

For more details on the best stocks and shares isa uk, explore our guide. See Trust Intelligence’s ratings at https://www.trustintelligence.co.uk/investor/articles/strategy-investor-the-best-stocks-shares-isa-providers for investor-focused insights.

Best junior stocks and shares ISAs for 2025

The best junior stocks and shares ISA for children under 18 allows parents or guardians to invest up to £9,000 annually tax-free, with funds locked until age 18 for long-term growth. Top picks include Hargreaves Lansdown and AJ Bell, offering low fees and educational tools, while Freetrade provides a simple app for family use. These ISAs averaged strong returns via diversified funds, supporting goals like university fees.

Unlike adult versions, juniors can’t withdraw early, emphasising patience. According to HMRC at https://www.gov.uk/junior-individual-savings-accounts, transfers from existing accounts are possible. For comparisons, check Forbes Advisor at https://www.forbes.com/uk/advisor/investing/best-stocks-and-shares-junior-isas/.

Best performing funds and managed ISAs

For the best performing stocks and shares ISA, focus on managed options or funds like Vanguard’s LifeStrategy series, which delivered around 8.5% annual returns over the last five years (2020-2024) through global diversification. In 2025, index funds tracking UK and international markets are projected to perform well amid economic recovery, per Money To The Masses at https://moneytothemasses.com/saving-for-your-future/investing/which-is-the-best-performing-stocks-and-shares-isa. Ethical choices, such as ESG funds from Royal London, cater to sustainable preferences without sacrificing returns.

Managed ISAs from Nutmeg or Wealthify automate portfolios for hands-off investing. Historical data from Morningstar at https://global.morningstar.com/en-gb/stocks/best-worst-performing-uk-stocks-november-2024 shows top UK all-companies funds up 10% year-to-date. Diversify to mitigate volatility.

- Vanguard FTSE Global All Cap Index: Low fees, broad exposure.

- Legal & General UK Index Trust: Tracks FTSE 100 efficiently.

- Best managed stocks and shares ISA: Wealthify for automated growth.

Pros, cons, and risks of stocks and shares ISAs

Pros include tax-free growth up to £20,000 yearly and potential for higher returns than cash ISAs, with 78% of UK adults unaware of this benefit per FCA’s 2025 survey at https://www.fca.org.uk/data/isa-awareness-2025. Cons involve market volatility—your investment could lose value—and platform fees impacting net gains.

Risks are higher than savings accounts; always diversify and consider your timeline. For basics on stock market basics, see our guide. Avoid if you need quick access to funds. Best stocks and shares isa for beginners often start with low-risk funds.

Frequently asked questions

What is the best stocks and shares ISA for beginners?

For beginners, platforms like Freetrade or Vanguard are ideal due to their simple interfaces, low or no trading fees, and access to ready-made index funds that reduce the need for stock-picking expertise. These options allow starting with as little as £1, helping new investors build confidence while benefiting from tax-free growth in a stocks and shares ISA. However, always assess your risk tolerance—volatility means potential losses, so diversify early and consider long-term horizons of at least five years.

How do I choose the best stocks and shares ISA?

Choosing the best stocks and shares ISA involves comparing fees (aim for under 0.45%), investment variety, and platform usability via tools on Money.co.uk at https://www.money.co.uk/savings-accounts/investment-isas. Factor in your goals: passive investors suit Vanguard, while active traders prefer Hargreaves Lansdown’s tools. Review 2025 updates for any regulatory changes from the FCA to ensure alignment with your strategy.

What are the best performing stocks and shares ISAs?

The best performing stocks and shares ISAs over the past five years featured global index funds from providers like Vanguard and AJ Bell, averaging 8.5% annual returns amid market growth. For 2025, expect similar from diversified portfolios tracking tech and renewables sectors, though past results don’t guarantee future gains. Monitor Morningstar data for ongoing performance and adjust for economic shifts like interest rate changes.

Which stocks and shares ISA has the lowest fees?

Vanguard leads with 0.15% fund fees, making it the lowest-cost option for passive investing in a stocks and shares ISA, far below the 0.25-0.45% average. Freetrade offers 0% on trades, suiting frequent small investors, while Interactive Investor’s flat monthly fee benefits larger portfolios. Low fees preserve returns, but balance with features—always check for hidden charges like exit fees.

Is a stocks and shares ISA worth it?

Yes, for long-term savers, as it shields gains from CGT (up to 20% otherwise) and income tax, potentially boosting returns significantly over cash ISAs’ 4-5%. With £20,000 allowance, it’s valuable if you can tolerate risk; studies show equities outperform savings over 10+ years. It’s not for short-term needs—consider your horizon and diversify to manage downside.

What is the best junior stocks and shares ISA for 2025?

AJ Bell and Hargreaves Lansdown top for junior ISAs with low fees and child-friendly tools, allowing £9,000 tax-free annual investments for growth until age 18. These suit parents planning for education or starters, offering funds with historical 7-9% returns. Compare via Good Money Guide at https://goodmoneyguide.com/investing/junior-stocks-shares-isas/ and remember funds are inaccessible early, promoting disciplined saving.